If you run an international online store, Shopify helps you preset tax rates by country. However, Shopify tax system has limitations and special setting is required for certain special rules. An example here would be the sale of medical products, which in some EU countries are taxed at lower rates or are entirely tax-exempt. Also, the total tax exemption in the UK for people with disabilities is often difficult for store owners to implement, as Shopify itself can only offer a limited solution for this issue.

What is possible?

Shopify offers some built-in tools that allow store owners to implement these special rules like tax reduction and VAT exemption. You can find out what these tools are here.

Tax overrides for certain products in certain countries

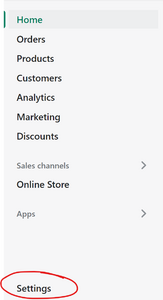

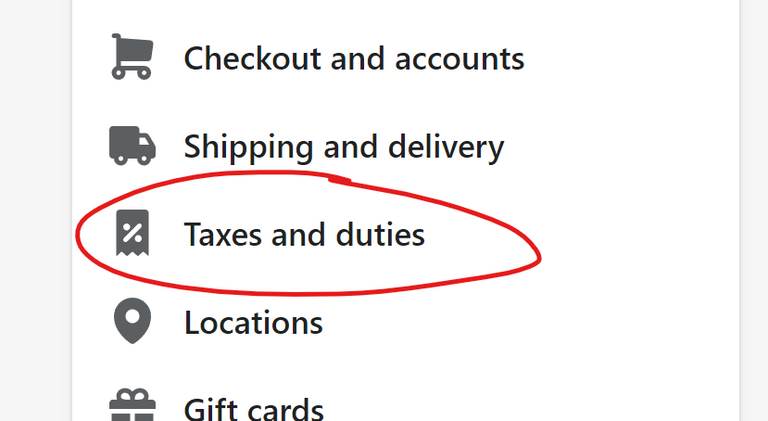

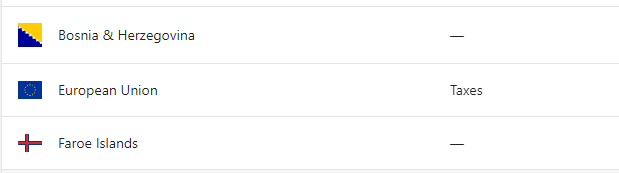

Shopify allows you to set up VAT exemption or VAT override for specific products in specific sales regions of your Shopify store. To set this up, you need to follow these steps:

4. activating and configuring the control override

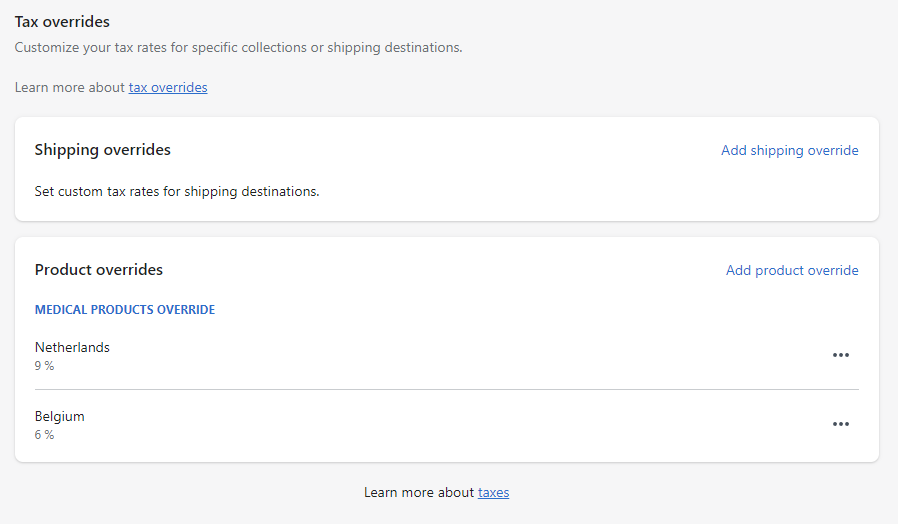

Scroll to the very bottom of the now opened page until you see the item Tax override.

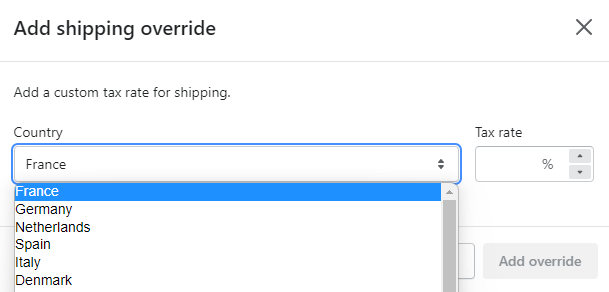

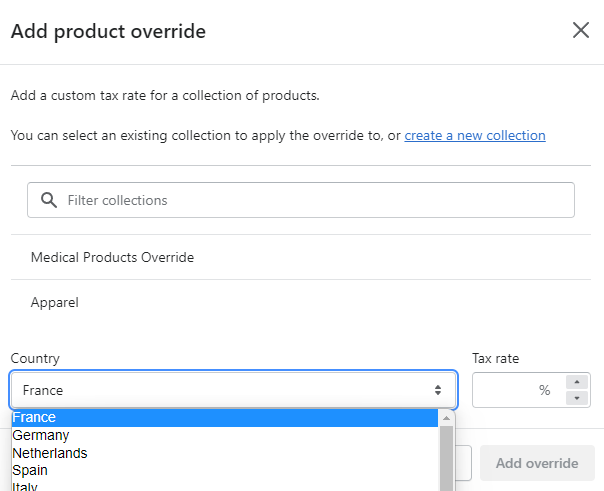

Here you can now set up two prescription types, which are Shipping costs override or the Product Tax Override, to do this, click on the link of the respective field. You then have the option to individual collections in your store for a particular country. It is important here that for product tax overrides only Manual collections can be used and no automatic, which are based on filters.

In the example, we have set up a tax reduction for Belgium and the Netherlands, as they have a reduced VAT rate on certain products.

It is best to ask your tax advisor or do your own Internet research on the products involved. For example here.

If you want to mark a product as tax free in a country, simply enter 0% in the tax rate field.